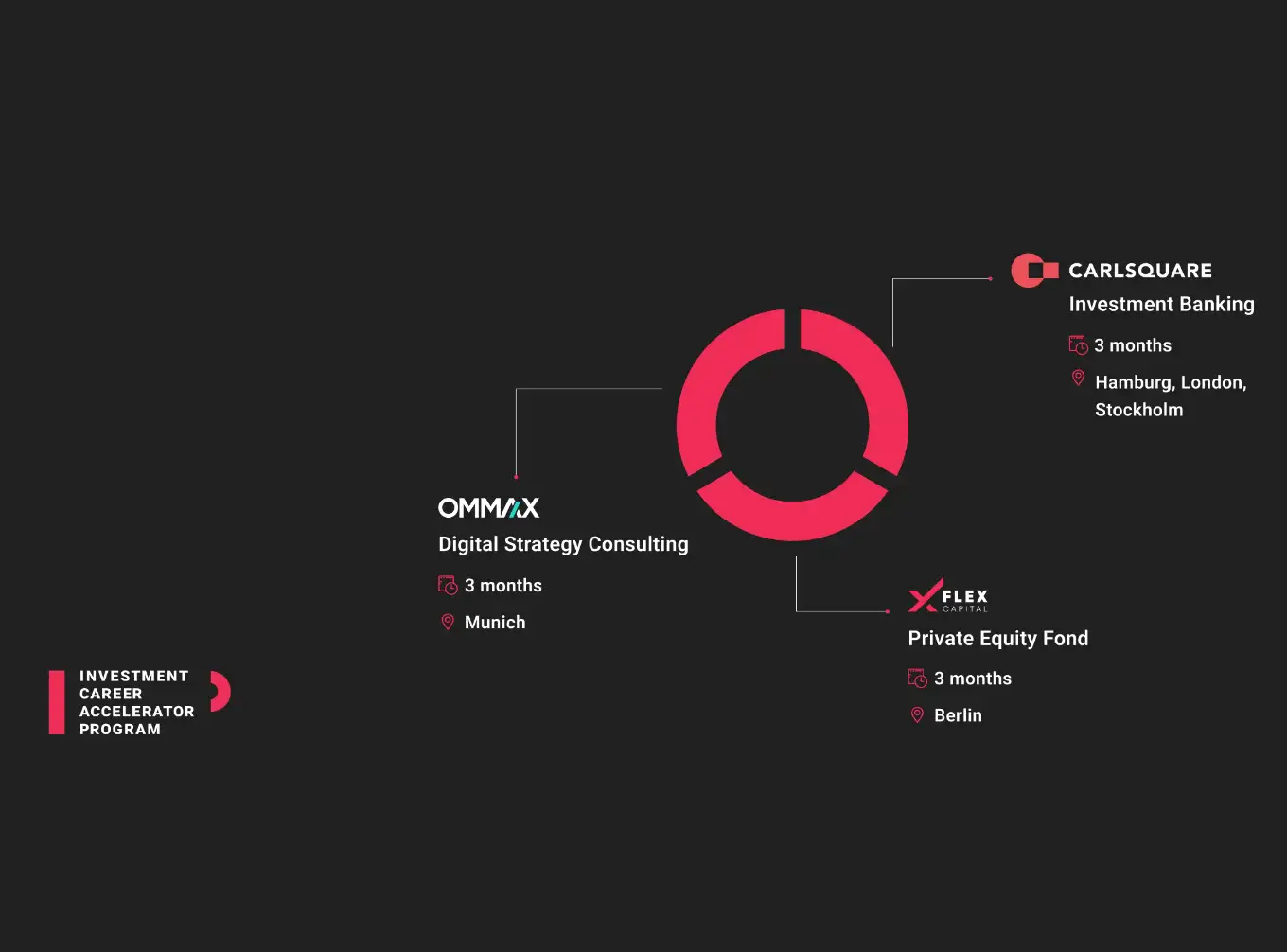

The next generation private equity fund

Founded by successful serial entrepreneurs, FLEX Capital is a

private equity fund that invests in profitable and fast-growing

companies in the German software and tech midmarket.

Currently, FLEX's portfolio includes 13 companies across five

platforms. In early 2023, FLEX closed its second EUR 300 million

fund with the aim of bringing more mid-cap pioneers to the global

stage. FLEX calls itself the next generation private equity fund,

as its entrepreneurial background and commercial fund structure is

very different from other funds.

Rather than just give advice from the sidelines, FLEX provides

hands-on and operational support to its portfolio companies with

the help of a team of 30 experts. Ecological and social goals as

well as responsible corporate governance are among the company's

core values.

LEARN MORE

Your tasks as a Private Equity Intern

-

Deal Sourcing: You will analyze markets and sectors of the

software industry in the DACH region to identify potential

investment targets

-

You will support the investment process: Your work will include

market and client analysis, preparation for and participation in

meetings with experts, clients and partners, financial analysis

and modeling, and contributions to investment committee memos

-

Portfolio work: You will support value generation activities

(e.g. implementation of strategic and operational projects)

-

Weekly meeting preparation: You will review deal flow, analyze

and present new investment opportunities and develop and present

market analysis

Contact

Gregor Hemeyer, Talent Partner

+49 151 513 07 599

gh@plus-scale.de